This month we’ve spent a considerable amount of time looking towards the future of the dairy industry. We’ve gathered great insight into a post-pandemic world at this year’s IFCN Supporter’s Conference and have delved deep into environmental responsibility. With enthusiasm and curiosity, we are considering what changes can and need to be made to continually improve and grow the industry.

Yet, to look ahead we must understand what is happening and has happened in the past. The dairy sector has already transformed so much, and farmers are constantly looking at new ways to develop, but what impact have recent developments had on businesses, livestock and milk production?

Key figures & drivers

The latest Milkminder report illustrates that the average total feed cost per litre has dropped by 6% over the period of a year. There is little difference in the total number of cows in the herd but, unusually, yield per cow has remained static. An average milk price reduction of 0.8 pence per litre is reflective of the challenges seen in the milk market, especially during spring and summer.

In summary, milk income has fallen by £73 per cow and this has been offset by savings in feed of £43 per cow. It is far from a disastrous situation, but there is no doubt cashflow will have been put under pressure on many farms. One thing to note, however, is that irrespective of the understandable stress and challenges presented by a turbulent political and social environment, producers have focused their attention on maintaining health and production while optimising feed intake to achieve the highest income over feed cost.

Improving profitability

If we look at the top 20% of farms by Margin over Purchased Feed, we can see some useful pointers for improving profitability. This group of farms produce a margin that is £437 per cow greater than that of the average group. On a 200-herd farm this equates to a £91,600 advantage. We can also see that they have higher yields, 11% more than the average, and a whopping 3.4 litres per cow in milk in July.

While the top 20% do spend more on feed, the overall feed rate is identical to the average farm. A good deal of the difference is contract related, with these farms averaging at 31.25 pence per litre compared to the average group on 28.38. However, even if we equalise the milk price across both groups, those in the top 20% make an additional £175 per cow in margin.

Looking at the results, it appears that a lot more attention is being paid to improving yield from home grown forage. The drought of 2018 has now completely wound its way out of the results, as farmers forage stocks have been replenished.

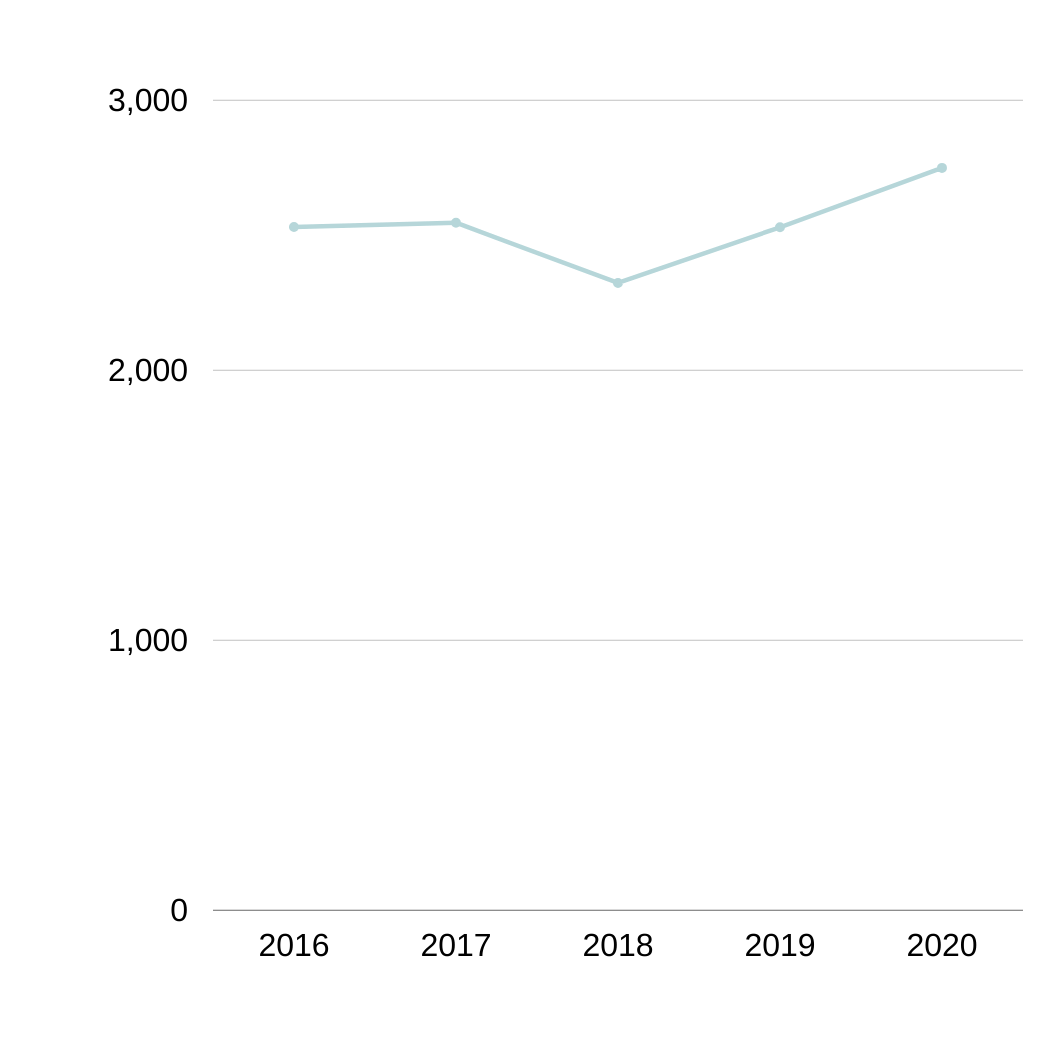

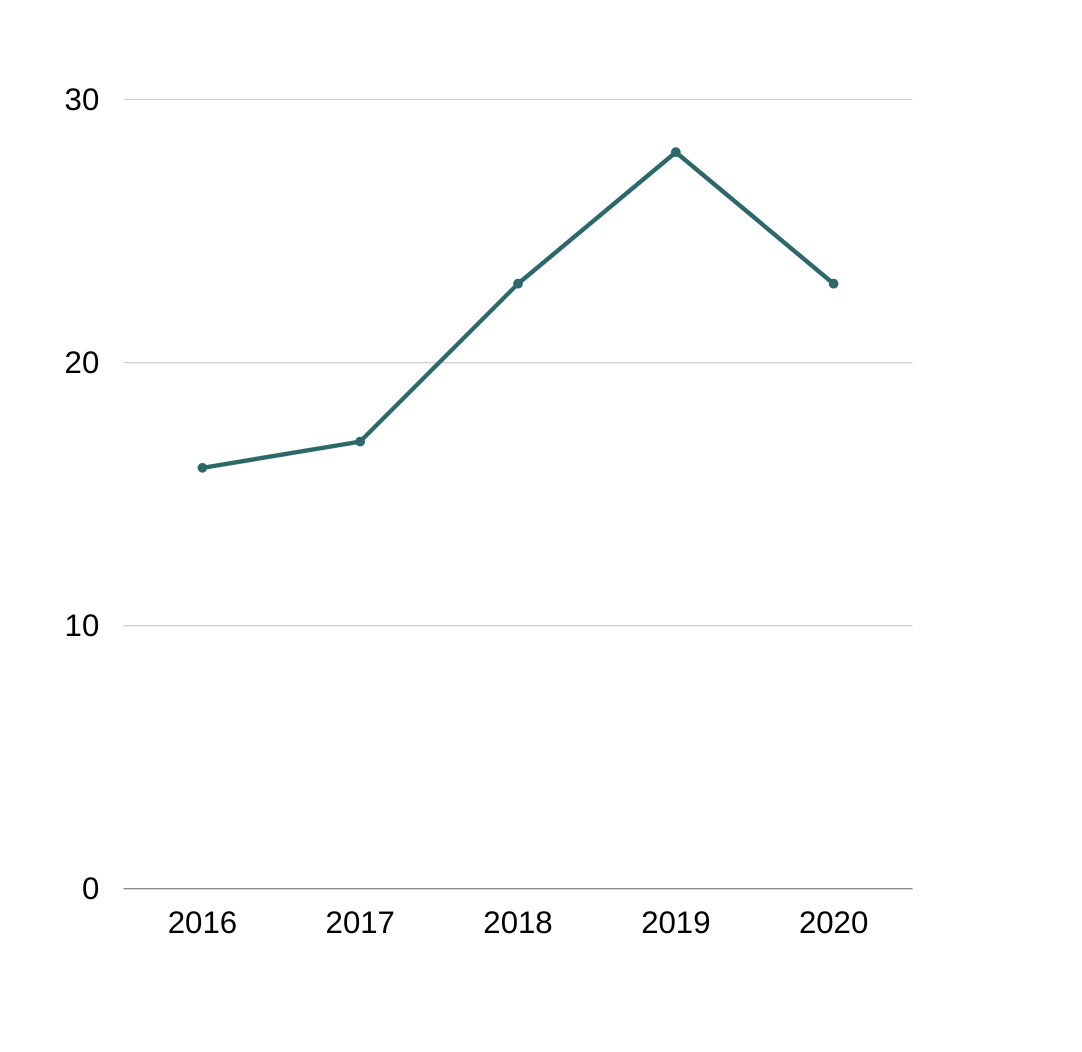

Yield from forage has increased by 8.1% (see figure 1) and spend on other purchased feeds, which are mostly replacement bulk products, has fallen by 18% on average (see figure 2). For the top 20% of farms, the improvements have been less. This suggests that output is pre-eminent in the strategy of these businesses – in July this group spent more on feed to get the same amount of milk as they did a year ago.

Figure 1 – Yield from Forage

Figure 2 – Other Feed Cost per Cow

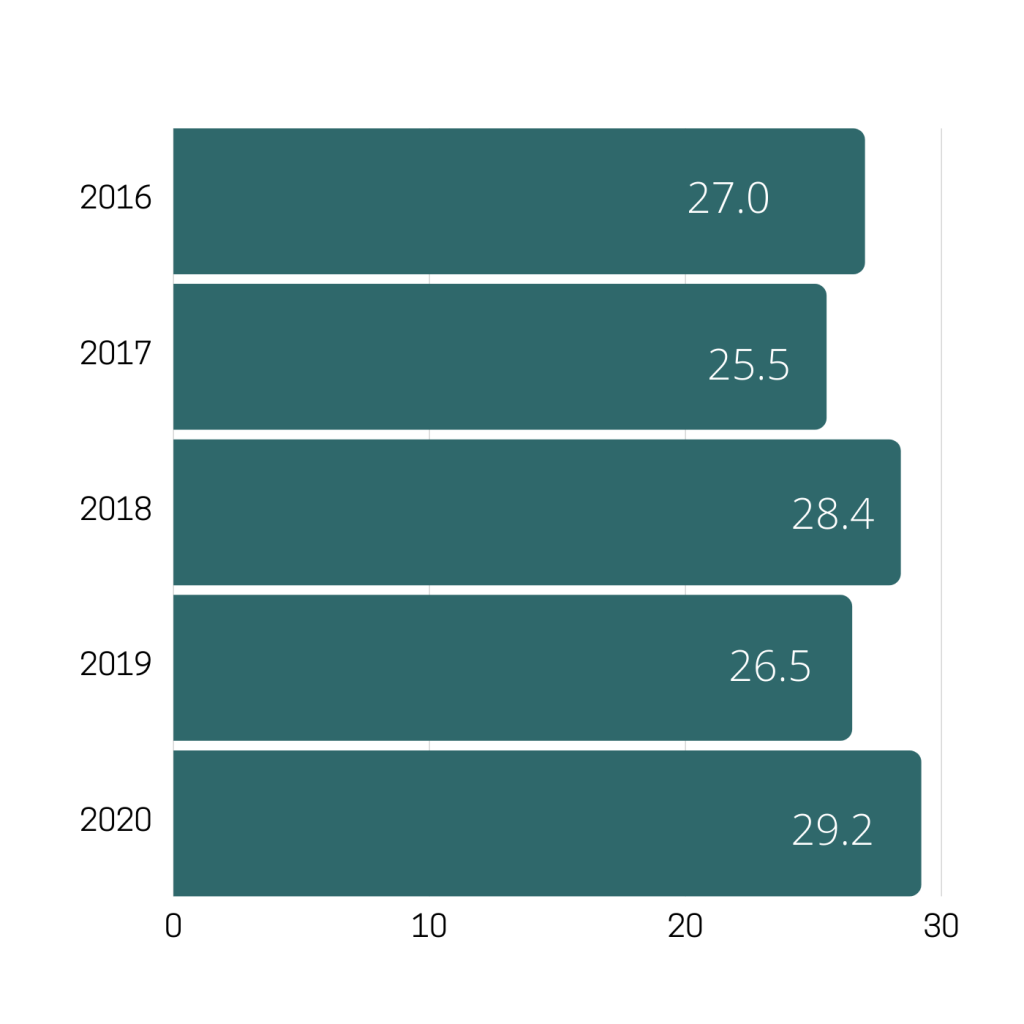

It is surprising to see such a large jump in herd replacement rate over the last year, increasing 3.2%. It is indicative of an increasing trend seen over several years (see figure 3). Speeding up the replacement rate will indeed increase genetic progress. But, with a replacement costing around £1,800, this surge will have increased costs on the average sized herd by £4500. This is equivalent to £21 per cow in the herd.

There are many compounding factors behind this number, including TB, availability of heifers and incentives to improve animal health. Understanding your reasons for culling is the first step towards putting an effective strategy in place. Lameness, in particular, is one of the most important drivers behind culling. Whether it be directly or because of the negative effect it has on fertility, it is a problem that needs to be considered.

While there is value in looking ahead and considering the future of dairy. To make valuable changes and to create an action plan, it is evident that producers must clearly understand their current position and that of the industry. We need to look at the now. Only by analysing up-to-date, accurate data can we go forward successfully and reduce the potential impact of future market conditions.